Market Outlook

January 22, 2018

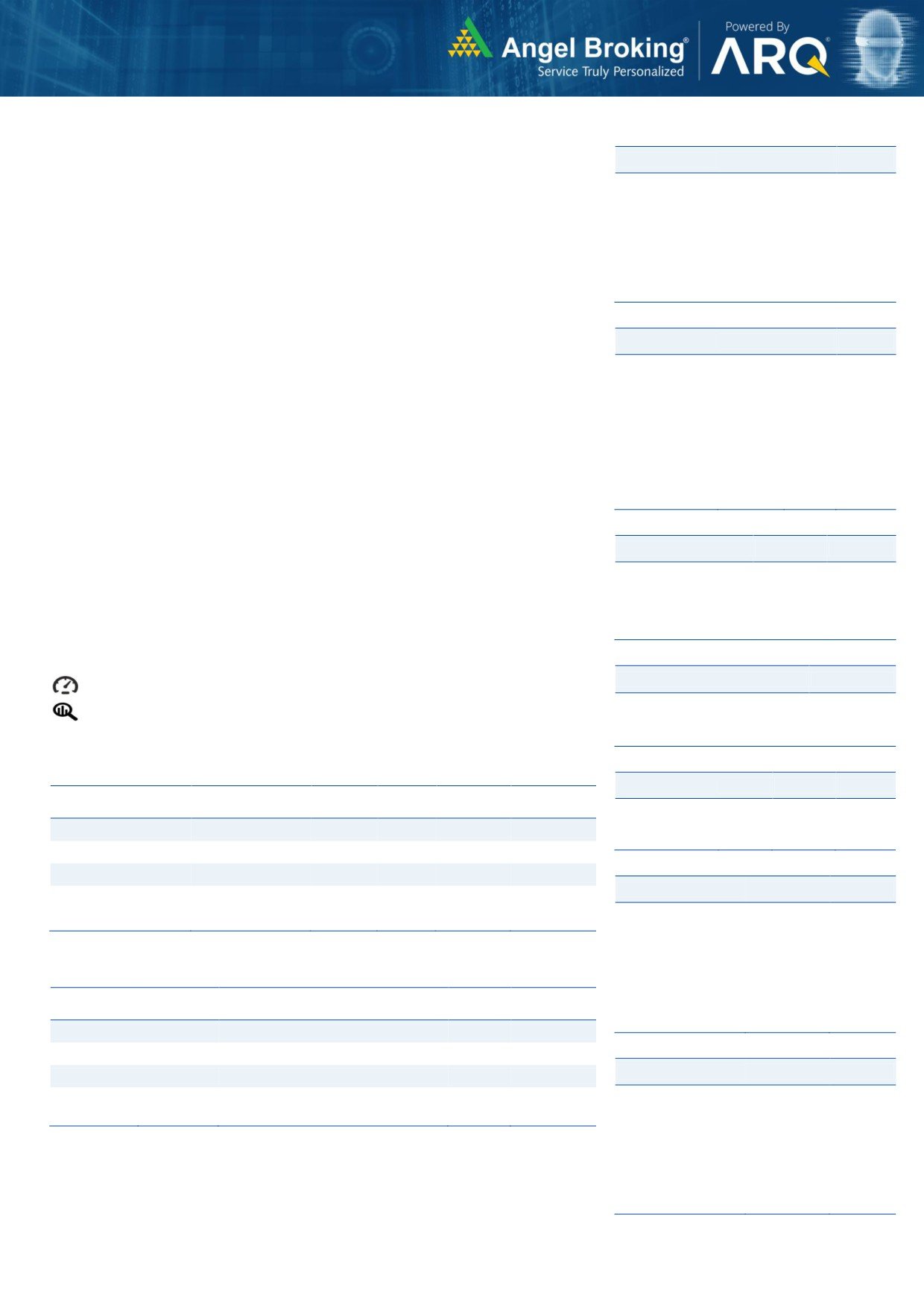

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open flat tracking global indices and SGX Nifty.

BSE Sensex

0.7

251

35,512

US stocks moved mostly higher over the course of the last trading session mainly

Nifty

0.7

78

10,895

due to the shrugging off concerns about a potential government shutdown. The Dow

Mid Cap

0.8

136

17,765

Jones ended on an upside front of 0.2% at 26,072 and the Nasdaq Composite

Small Cap

0.9

170

19,456

edged up to 7,336 with an upside front of 0.6%.

Bankex

1.5

456

30,473

U.K. shares were little changed as oil and retail stocks came under selling pressure,

offsetting gains in the mining sector following stronger-than-expected GDP data

Global Indices

Chg (%)

(Pts)

(Close)

from top metals consumer China. The FTSE 100 was up by 0.4% to close at 7,731.

Dow Jones

0.2

54

26,072

Nasdaq

0.6

40

7,336

On domestic front, Indian shares continued to move higher to hit fresh record highs

for the third straight session and the GST Council decided to cut tax rates on 29

FTSE

0.4

30

7,731

products and 53 services, in what is seen as the biggest overhaul since the launch of

Nikkei

0.2

45

23,808

GST. The Sensex edged up to 0.7% at 35,512 while the Nifty ended at 10,895 with

Hang Seng

0.4

133

32,255

an upside of 0.7%.

Shanghai Com

0.4

13

3,488

News Analysis

Advances / Declines

BSE

NSE

Result Review: HCL Tech (CMP: `958 / TP: `1,014/ Upside: 5.8%)

Advances

1,402

910

Result Review: Wipro (CMP: `328 /`289 TP: / Upside: -11.9%)

Declines

1,510

886

Detailed analysis on Pg2

Unchanged

131

52

Investor’s Ready Reckoner

Volumes (` Cr)

Key Domestic & Global Indicators

BSE

5,498

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

NSE

33,320

Top Picks

Net Inflows (` Cr)

Net

Mtd

Ytd

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

FII

1,918

5,236

5,236

Blue Star

Capital Goods Accumulate

773

867

12.1

*MFs

(344)

4,244

4,244

Dewan Housing Finance

Financials

Buy

613

712

16.2

Asian Granito

Other

Accumulate

584

651

11.5

Top Gainers

Price (`)

Chg (%)

Navkar Corporation

Other

Buy

200

265

32.6

KEI Industries

Capital Goods Accumulate

393

436

11.0

Gruh

691

16.3

More Top Picks on Pg4

Cyient

653

12.4

Swanenergy

229

7.7

Key Upcoming Events

Previous

Consensus

Jublfood

2,092

7.7

Date

Region

Event Description

Reading

Expectations

Radico

365

7.0

Jan23

Germany PMI Manufacturing

63.30

Jan24

Euro Zone Euro-Zone Consumer Confidence

0.50

Top Losers

Price (`)

Chg (%)

Jan24

Germany PMI Services

55.80

Jan24

US

Existing home sales

5.81

5.68

Religare

52

(4.9)

Jan24

UK

Jobless claims change

5.90

Videoind

22

(3.5)

More Events on Pg7

Strtech

376

(3.2)

Kansainer

528

(2.8)

Ambujacem

269

(2.7)

As on January 19, 2018

Market Outlook

January 22, 2018

News Analysis

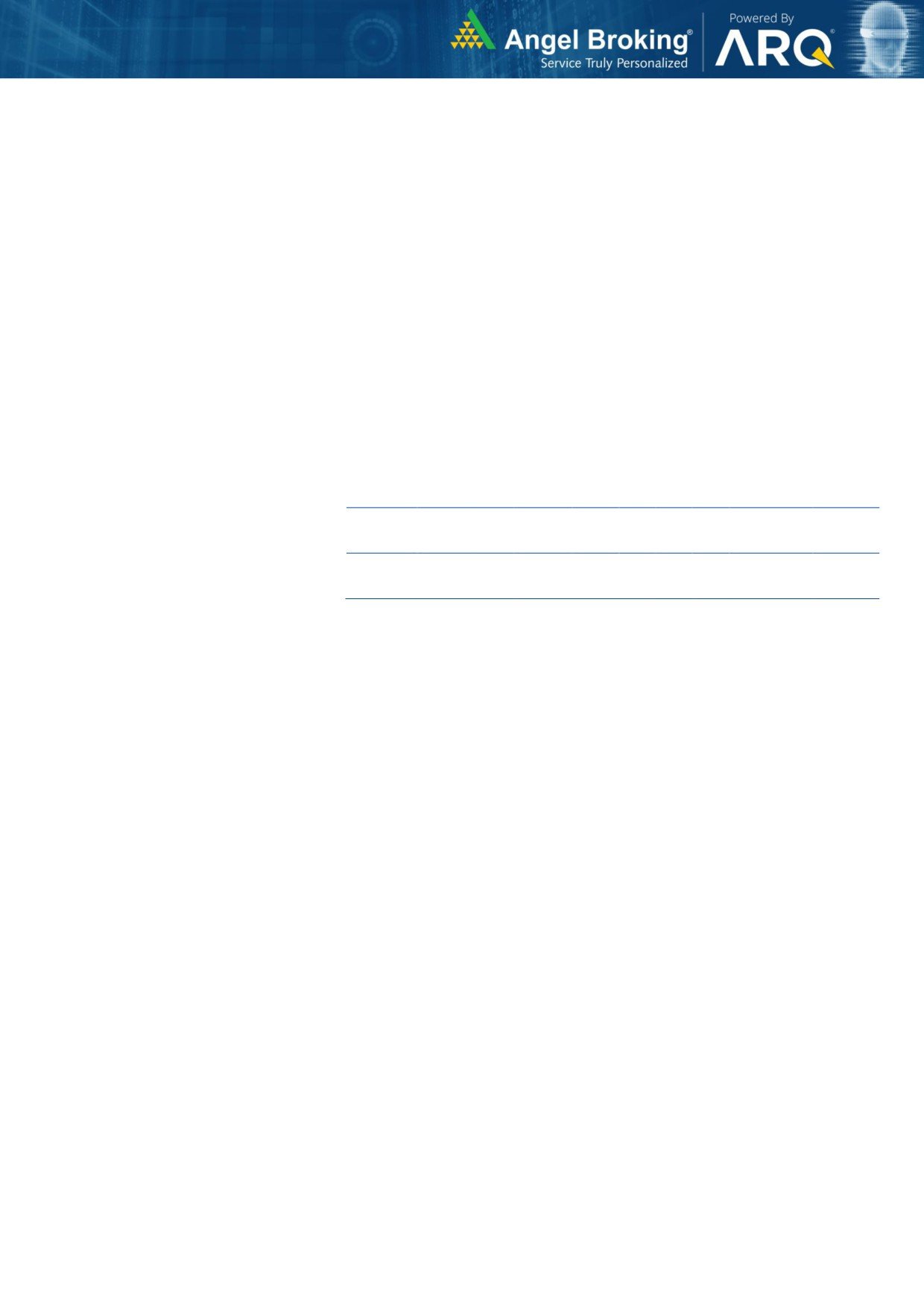

Result Review: HCL Tech (CMP: `958 / TP: `1,014/ Upside: 5.8%)

HCL Tech, for 3QFY2018 posted better than expected results. The sales came in at

US$1,988mn v/s US$1,977mn expected and V/s US$1,929mn in 2QFY2018,

registering a qoq growth of 3.1%. On constant Currency (CC) terms, the company

posted a qoq growth of 3.3%. In rupee terms, revenues came in at `12,808cr V/s

`12,795cr expected V/s `12,434cr in 2QFY2018, up 3.1% qoq.

In terms, of the geography the USA posted a qoq 4.9% CC growth, Europe posted

a 1.9% qoq CC growth & ROW posted a 3.9% CC dip during the quarter. In

terms, of the verticals, the Manufacturing and Retail & CPG were the key growth

driver for the company registering a CC qoq growth of 6.6%. Life Sciences &

Healthcare posted a qoq CC growth of 2.4%, while Financial Services posted a

moderate 1.4% CC qoq growth during the quarter.

On EBIT front, the company posted an EBIT of 19.6% V/s 19.7% expected V/s

19.7% in 2QFY2018. The margins held up only up on back of 85.8% capacity

utilization V/s 86.0% in 2QFY2018. Consequently, the PAT came in at `2,194cr

V/s `2,168cr expected V/s `2,188cr in 2QFY2018, growth of 0.3% qoq.

In terms of guidance, the company expects FY'2018 revenues to grow between

10.5-12.5% in Constant Currency. The above constant currency guidance

translates to 12.1% to 14.1% in US$ terms based on December 31, 2017 rates.

Operating Margin (EBIT) for FY’2018 is expected from 19.5% to 20.5%.

We maintain our accumulate rating on the stock, with a price target of `1,014.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

50,099

22.1

8,857

62.8

22.4

15.3

3.4

10.5

2.3

FY2019E

54,608

22.1

9,537

67.6

20.6

14.2

2.9

9.1

2.0

Result Review: Wipro (CMP: `328 /`289 TP: / Upside: -11.9%)

Wipro, posted numbers in line with expectations on the EBIT front, while sales and

net profit came below expectations. Company’s IT services posted a flat qoq

growth in USD revenues to US$2,014mn V/s US$2,035mn expectations V/s

US$2,013mn in 2QFY2018. On Constant Currency (CC) terms, the company

posted a 0.9% qoq growth. In rupee terms, consolidated revenues came in at

`13,669cr V/s `13,450cr expectations V/s `13,423cr in 2QFY2018, up 1.8% qoq.

The growth in terms of geography the growth was mainly driven by Europe (4.7%

qoq CC growth), India & Middle East (1.4% qoq CC growth) business. In terms of

verticals, the growth was driven by the BFSI (4.4% qoq CC growth) and Healthcare

(2.5% qoq CC growth) segments. The key vertical of the company Energy, Natural

Resources and Utilities (6.1% qoq Cc de-growth). Manufacturing and Technology,

posted a flat CC qoq growth during the period. Digital revenue surpassed 25% of

its IT Services business.

On EBIT front, the company posted an EBIT of 16.8% V/s 16.8% in 2QFY2018; in

line with expectations. Consequently, the Adj. PAT came in at `2,255cr V/s

`2,147cr expected V/s `2,191cr in 2QFY2018, growth of 2.9% qoq. During the

quarter, company reported an impact of

`317.5cr, made with respect to

Market Outlook

January 22, 2018

insolvency of a customer post the balance sheet date. Thus reported PAT came in

`1,937cr, registering a qoq dip of 11.6%.

On, the operational front the company had utilization levels of 71.0% V/s 72.9%

in 2QFY2018. The attrition rate during the quarter was 15.9% V/s 15.7% in

2QFY2018. In terms of the client addition, the company added 79 clients. It

added one client in the US$75mn+, 2 in the US$50mn. For 4QFY2018, the

company has given, guidance of US$2,033-US$2,073mn, a CC qoq growth of 1-

3%.

Overall, the current quarter numbers were below expectations. Going forward into

the next quarter, the company is given a guidance, which is higher and is in line

with its earlier commentary that they expect a gradual improvement form

4QFY2018. The client additions have been healthy, with good additions in the

high sales ticket sizes also. While Wipro has been improving its operating

performance, its top line growth has been muted. Thus as we move into FY2019,

for Wipro its imperative it grows its sales, along with improving its operating

leverage. As of now, on back of the valuations, we maintain our reduce rating on

the stock, with a price target of `289.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

54,164

22.3

9,156

18.8

15.8

17.5

2.9

9.1

2.0

FY2019E

56,544

22.3

9,488

19.5

14.8

16.8

2.7

8.3

1.9

Economic and Political News

Mauritius largest source of FDI in India followed by US, UK: Reserve Bank

Indian crypto currency investors get I-T notices as trading hits Rs 224bn

Swiss President to discuss trade pacts with Modi in Davos next week

Corporate News

Tata Trusts' MD moves HC against quashing of summons to Cyrus Mistry

Mercedes-Benz India becomes 1st to launch BS-VI-compliant locally-made

car

Trai directs Reliance Communications to refund unspent money of customers

Rio Tinto eyes tie-up with Chhattisgarh miners, execs meet CM in Australia

Market Outlook

January 22, 2018

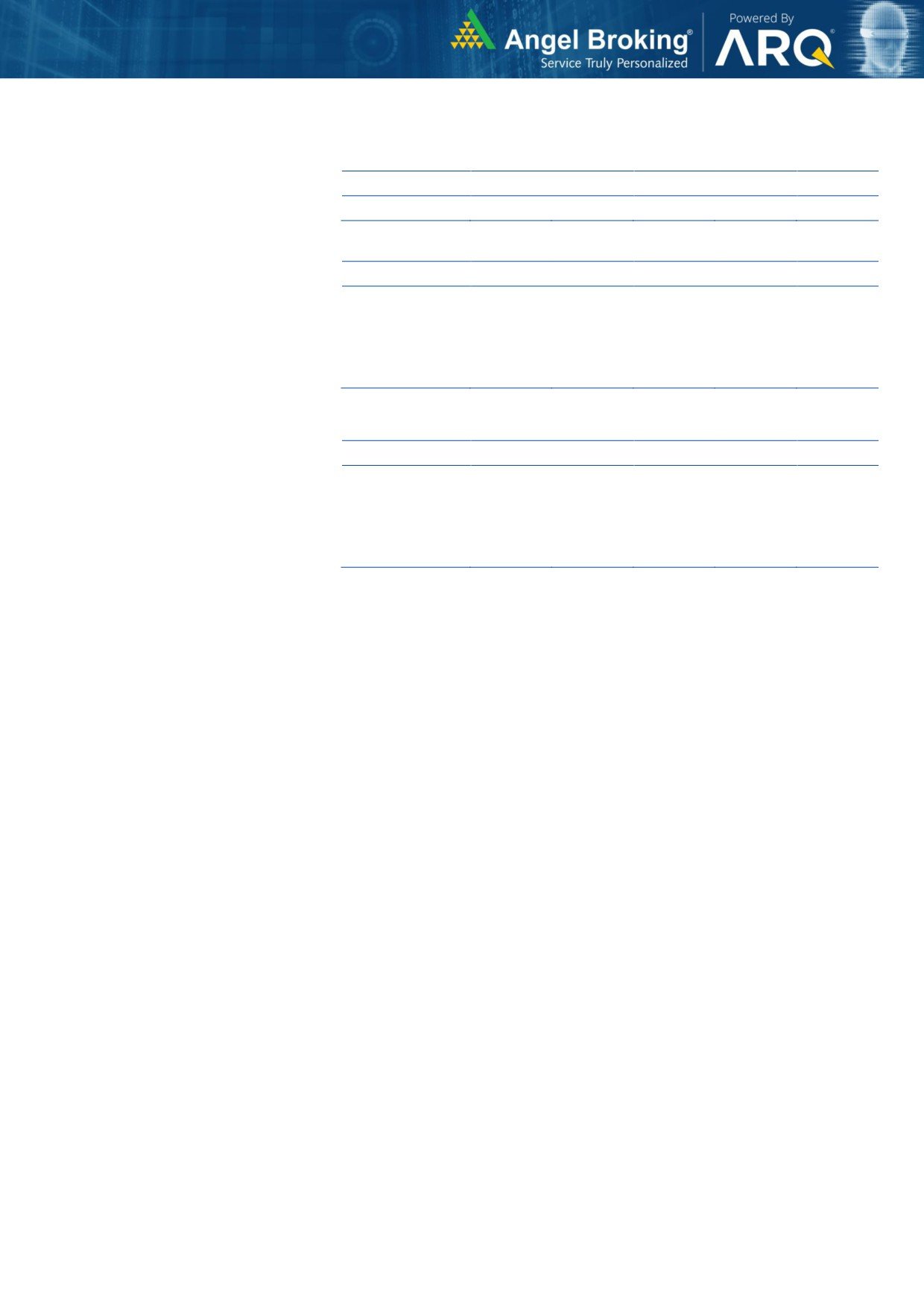

Quarterly Bloomberg Brokers Consensus Estimate

Axis Bank - Jan 22, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

PAT

818

579

41.2

432

89.3

Havells - Jan 22, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

1,987

1,506

31.9

1,777

11.8

EBIDTA

260

192

35.4

256

1.5

%

13.1

12.8

14.5

PAT

168

152

10.5

171

(1.8)

Asian Paints - Jan 22, 2018

Particulars ( ` cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

Sales

4,552

3,937

15.6

4,265

6.8

EBIDTA

886

776

14.2

801

10.6

%

19.5

19.7

18.8

PAT

559

489

14.3

593

(5.8)

Market Outlook

January 22, 2018

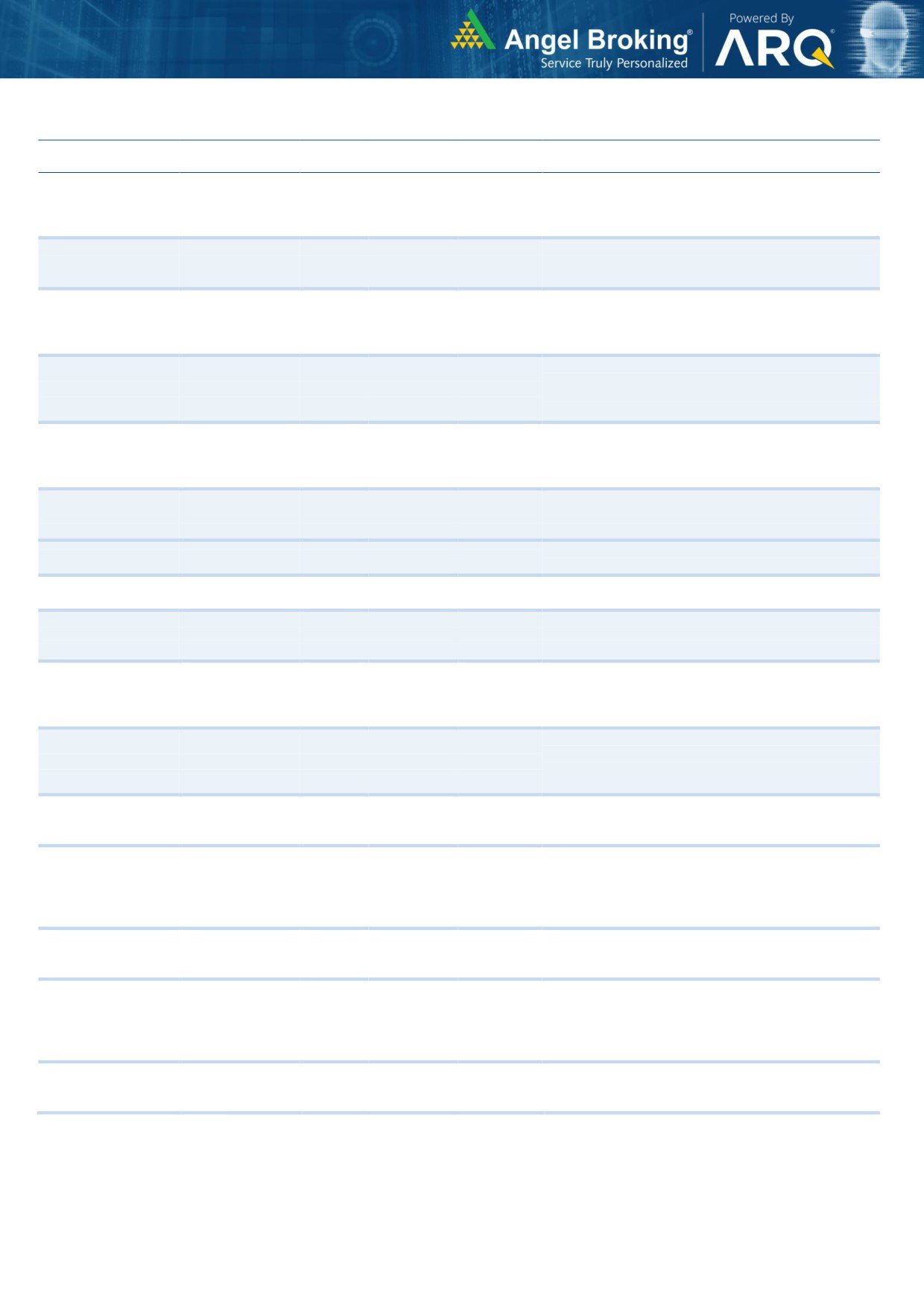

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its

leade`hip in acute therapeutic segment. Alkem expects

Alkem Laboratories

26,531

2,219

2,441

10.0

to launch more products in USA, which bodes for its

international business.

We expect the company would report strong

Asian Granito

1,757

584

651

11.5

profitability owing to better product mix, higher B2C

sales and amalgamation synergy.

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the

Blue Star

7,419

773

867

12.1

market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

19,212

613

712

16.2

presence in tier-II & III cities where the growth

opportunity is immense.

Loan growth is likely to pick up after a sluggish FY17.

Lower credit cost will help in strong bottom-line

Karur Vysya Bank

8,380

115

160

38.7

growth. Increasing share of CASA will help in NIM

improvement.

High order book execution in EPC segment, rising B2C

KEI Industries

3,078

393

436

11.0

sales and higher exports to boost the revenues and

profitability

Expected to benefit from the lower capex requirement

Music Broadcast

2,254

395

475

20.3

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage

Navkar Corporation

3,007

200

265

32.6

at ICD as well CFS augur well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

3,489

744

851

14.3

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no. 2

viewership ranking in English news genre, exit from the

TV Today Network

2,701

453

500

10.4

radio business, and anticipated growth in ad spends

by corporate to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The

Maruti Suzuki

2,81,579

9,321

10,619

13.9

Gujarat plant will also enable higher operating

leverage which will be margin accretive.

We expect loan book to grow at 24.3% over next two

GIC Housing

2,408

447

655

46.5

year; change in borrowing mix will help in NIM

improvement

We expect CPIL to report net Revenue/PAT CAGR of

~17%/16% over FY2017-20E mainly due to healthy

7,701

347

400

15.4

growth in plywood & lamination business, forayed into

Century Plyboards India

MDF & Particle boards on back of strong brand &

distribution network.

We expect sales/PAT to grow at 13.5%/20% over next

LT Foods

2,968

93

128

37.9

two years on the back of strong distribution network &

addition of new products in portfolio.

We expect sales/PAT to grow at 13%/16% over next

two years on the back of strong healthy demand in

Ruchira Papers

440

196

244

24.3

writing & printing paper and Kraft paper. Further,

China had banned making paper from waste pulp

which would benefit Indian paper companies.

We expect financialisation of savings and increasing

Aditya Birla Capital

39781

177

230

30.6

penetration in Insurance & Mutual fund would ensure

steady growth.

Source: Company, Angel Research

Market Outlook

January 22, 2018

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

3,906

294

360

22.6

over FY18-20 backed by capacity expansion and new

geographical foray

We forecast Nilkamal to report top-line CAGR of ~9%

to `2,635cr over FY17-20E on the back of healthy

Nilkamal

2,883

1,932

2,178

12.7

demand growth in plastic division. On the bottom-line

front, we estimate ~10% CAGR to `162cr owing to

improvement in volumes.

We expect sales/PAT to grow at 9%/14% over next two

years on the back of healthy demand growth in

Shreyans Industries

280

203

247

21.9

printing. Further, China had banned making paper

from waste pulp which would benefit Indian paper

companies.

The prism has diversified exposure in the different

segment such as Cement, Tile & ready mix concrete.

Prism Cement

7,143

142

160

12.8

Thus we believe, PCL is in the right place to capture

ongoing government spending on affordable housing

and infrastructure projects.

Source: Company, Angel Research